Implied Volatility Model.

Have you ever wondered why options prices can vary so much, even when the underlying asset’s price hasn’t changed? The answer lies in a powerful concept called implied volatility. Today, we’ll explore what implied volatility is, why it matters, and how it’s calculated using models like Black-Scholes

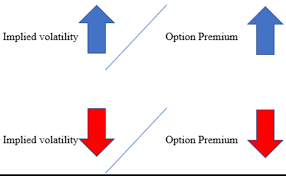

Implied volatility is a metric that reflects the market’s expectation of how much a security or asset’s price will move in the future. It’s derived from the price of options.

The volatility smile effect is an empirical fact that the BSM model fails to explain.

Unlike the flat volatility surface assumed by the Black-Scholes model, real-world markets often exhibit higher implied volatilities for options that are far out-of-the-money (OTM) or in-the-money (ITM). This creates a ‘smile’ shape when plotted. For example, during times of market uncertainty, out-of-the-money put options tend to have higher implied volatilities because investors are willing to pay a premium for protection against downside risk.This is among the limitations of the BSM model.

Let’s define the market dynamics: The security price.

The price of the standard European call option:

we will define The actual market prices as

having both the BSM price and the actual market price We can now compare

Newton-Rhapson

Newton’s method is an iterative update rule for finding the roots of an

equation

For an arbitrary equation where computing the derivative

We can use Newton-Rhapson to find the solution for the Implied volatility problem.

With Newton’s method being an iterative method; we are trying to solve

from an initial guess

Using Newton’s method means we have to differentiate the Black-Scholes formula with respect to sigma. This derivative is the vega for a European call option is

In practice

- Changes with T for fixed K and

- Changes with K for fixed T as a convex function (hence the name smile effect). This change appears to be more delicate.

BSM model assumes constant volatility which is not true.

Volatility surface

The Black-Scholes model implies that

Some key observation of the volatility surface is that:

-

Options of lowerstrikes tend to have higher implied volatilities

-

For a given maturity T, this feature is called volatility skew or volatility smile

-

For a given strike, K, the implied volatility can be either increasing or decreasing with T

In general,

As

Implementation in Python

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

from scipy.stats import norm

import matplotlib.pyplot as plt

import numpy as np

import matplotlib.pyplot as plt

from mpl_toolkits.mplot3d import Axes3D

from scipy.interpolate import griddata

import pandas as pd

#Define the BSM Call Function.

def europeanCallOptionPrice(S, K, r, sigma, T):

d1 = (np.log(S / K) + (r + 0.5 * sigma**2) * (T)) / (sigma * np.sqrt(T))

d2 = d1 - (sigma * np.sqrt(T))

callPrice = S * norm.cdf(d1) - (K * np.exp(-r * T) * norm.cdf(d2))

return callPrice

#Define Vega the deriviative of the BSM with respect to sigma.

def vega(S, K, r, sigma, T):

d1 = (np.log(S / K) + (r + 0.5 * sigma**2) * T) / (sigma * np.sqrt(T))

vega = S * np.sqrt(T) * norm.pdf(d1) * np.exp(-r *T)

return vega

#Define the implied volatility function.

def impliedVolatility(currentCallPrice, S, K, r,T, maxIter=10000):

sigma = 0.15

tolerance = 0

for i in range(maxIter):

optionPrice = europeanCallOptionPrice(S, K, r, sigma, T)

derivative = vega(S, K, r, sigma, T)

#Objective function. - the diffrence between the call price with the initali call price.

diff = optionPrice - currentCallPrice

if diff == tolerance:

sigma = sigma

sigma -= diff / derivative

return sigma

T = [0.25, 0.5, 1.0, 1.5]

K = [60, 70, 80, 90, 100, 110, 120, 130, 140]

#Initiate the matrix.

VolatilitySurfaceMatrix = [[0 for _ in range(len(T))] for _ in range(len(K))]

S = 100

r = 0.03

sigma = 0.05

for i in range(len(K)):

for j in range(len(T)):

k = K[i]

t = T[j]

C = europeanCallOptionPrice(S, k, r, sigma, t)

VolatilitySurfaceMatrix[i][j] = impliedVolatility(C, S, k, r,t)

VolatilitySurfaceMatrix

#Create a meshgrid for strike prices and maturities

T_mesh, K_mesh = np.meshgrid(T, K)

#Convert the surface matrix to a numpy array

VolatilitySurfaceMatrix = np.array(VolatilitySurfaceMatrix)

#Create a 3D plot

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

#Plot the surface

ax.plot_surface(K_mesh, T_mesh, VolatilitySurfaceMatrix, cmap='viridis')

#Set labels and title

ax.set_xlabel('Strike Price')

ax.set_ylabel('Maturity')

ax.set_zlabel('Implied Volatility')

ax.set_title('Implied Volatility Surface')

# Show the plot

plt.show()

VolatilitySurfaceMatrix = np.array(VolatilitySurfaceMatrix)

# Set up the desired grid for interpolation

TInterp = np.linspace(min(T), max(T), 100)

KInterp = np.linspace(min(K), max(K), 100)

TInterpMesh, KInterpMesh = np.meshgrid(TInterp, KInterp)

# Perform linear interpolation on the surface matrix

VolatilitySurfaceMatrix_interp = griddata((T_mesh.flatten(), K_mesh.flatten()), VolatilitySurfaceMatrix.flatten(),

(TInterpMesh,KInterpMesh), method='linear')

# Create a 3D plot

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

# Plot the interpolated surface

ax.plot_surface(KInterpMesh,TInterpMesh, VolatilitySurfaceMatrix_interp, cmap='viridis')

# Set labels and title

ax.set_xlabel('Strike Price')

ax.set_ylabel('Maturity')

ax.set_zlabel('Implied Volatility')

ax.set_title('Implied Volatility Surface (Interpolated)')

# Show the plot

plt.show()

Refrences

- https://www.kent.ac.uk/learning/documents/slas-documents/implied-volatility.pdf